An Evaluation of Business, Financial, and Economic Conditions

Collective Strength

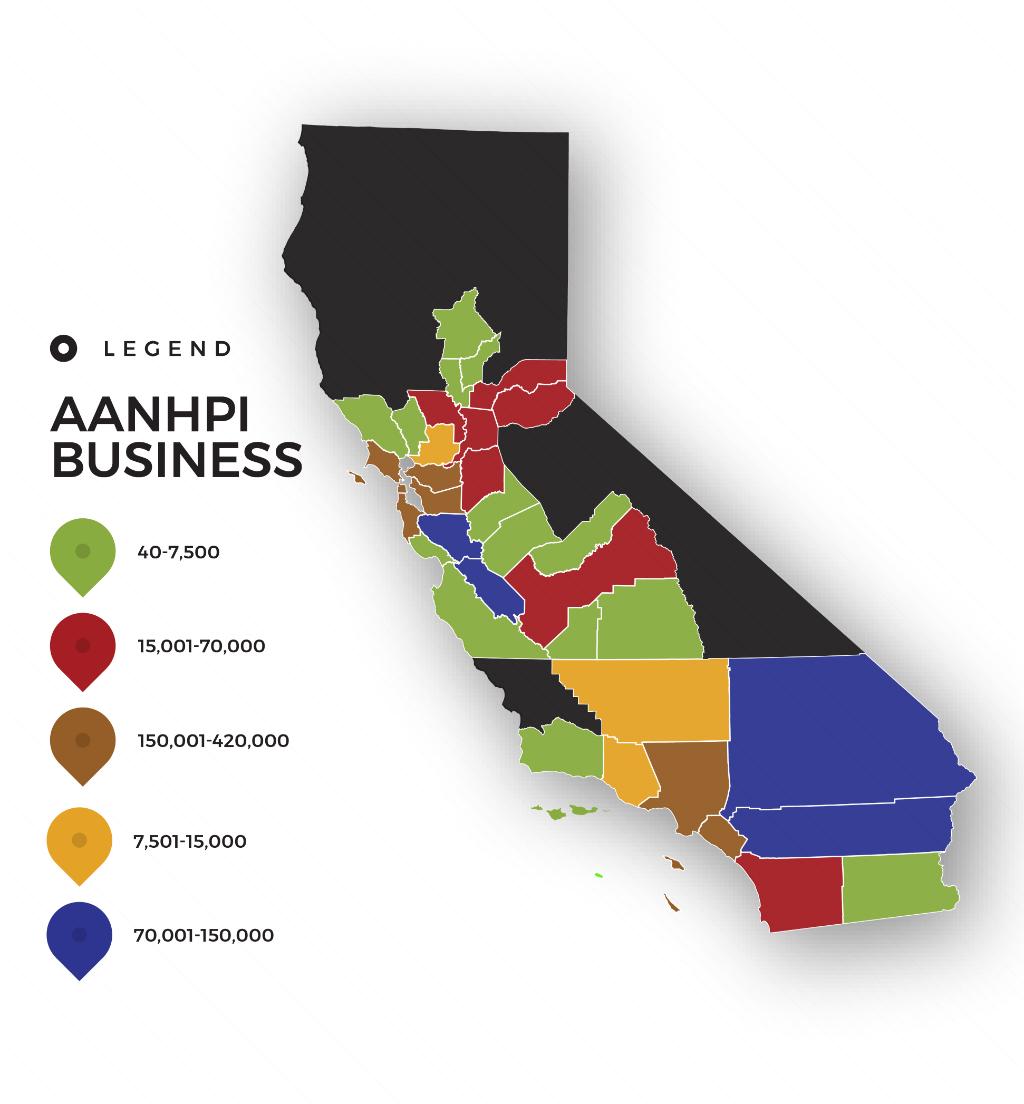

The Asian Business Association Foundation commissioned this study to evaluate the economic, commercial, and community dynamics of Asian, Native Hawaiian, and Pacific Islander (AANHPI) -owned businesses in post-pandemic California.

Using federal datasets, survey instruments, geographic information systems (GIS) maps, and economic modeling software, the report is a comprehensive profile of AANHPI businesses in the state and provides an unrivaled examination of significant issues and challenges they face today. The report’s findings are compelling and are key to fostering meaningful dialogue and solutions to help our diverse business community continue to grow and succeed. It is our hope that this study can be a cornerstone for more research and scholarly work on this vital subject in the years ahead.

We believe the future of the AANHPI business community continues to remain bright despite the challenges of the COVID-19 pandemic and marketplace barriers, both past and present. In California, the Census Bureau counted approximately 943,135 AANHPI-owned businesses in 2021, which employ 1.2 million workers, generate $41.1 billion in sales activity, and have an annual payroll of $65.9 billion.1 AANHPI-owned enterprises comprise 22.4% of all businesses in the state, more than double the share of AANHPI-owned enterprises nationally. 2

Elected officials, government agencies, and the greater business community have an essential role to play. With more business sector data and analysis available, local and state resources can be targeted to help AANHPI proprietors who need it most, and meaningful partnerships and programs should be followed to build a more inclusive economy.

Elected officials, government agencies, and the greater business community have an essential role to play. With more business sector data and analysis available, local and state resources can be targeted to help AANHPI proprietors who need it most, and meaningful partnerships and programs should be followed to build a more inclusive economy.

1 U.S. Census Bureau, U.S. Department of Commerce, and U.S. Census Bureau, “Nonemployer Statistics by Demographics series (NES-D): Statistics for Employer and Nonemployer Firms by Industry, Sex, Ethnicity, Race, and Veteran Status for the U.S., States, Metro Areas, and Counties: 2021,” 2021. Economic Surveys, ECNSVY Nonemployer Statistics by Demographics Company Summary, Table AB2100NESD01, 2021, accessed on July 25, 2024, https://data.census.gov/table/ABSNESD2021.AB2100NESD01?q=AB2100NESD01. 2 Ibid.

What our report found

Economic Impact

AANHPI establishments have a total economic impact of $200.7 billion in California, which includes all direct, indirect and induced effects on employment, labor income, and economic output.

Key Industries

Most AANHPI firms in the state are concentrated in five key industries – health and social assistance (17%), accommodation and food services (16%), professional scientific and technical services (13%), retail (10%), and wholesale trade (10%). Immigration plays a major factor in business sector choices.

COVID Impact

AANHPI business owners had a disproportionately negative experience during the COVID-19 pandemic, and were challenged with significant revenue declines, technological adaptation issues, racism, and financial uncertainty. Our investigation, however, identified a number of indicators from survey responses and executive interview sessions that suggest there has been widespread financial recovery and business resilience.

Financial Challenges

When asked to identify the most significant financial challenges their business was currently facing, most AANHPI survey responses were given for “high operating expenses (rent, utilities, supplies” (40.1%), followed by the increased cost of supplies or services (35.9%) and decreased sales of revenue (34.6%).

Growth Opportunities

Most survey participants indicated a growth mindset; the top answer choice for primary goals for the remainder of the year was for expanding their customer base (38.9%), followed by launching new products or services (36.5%), and increasing sales or revenue (35.4%).

Challenges

The main barrier to recruiting new employees across all regions was “high cost of living,” underscoring California’s housing affordability crisis.

Support Needed

On the issue of support and resources most sought by California AANHPI-owned businesses, the top response chosen by participants was marketing and advertising support (26.3%), with business mentoring or coaching (18.9%), and technology or digital tools (13.9%) trailing.

Businesses Improving

We saw a clear indication that most AANHPI businesses have improved since pre-pandemic levels — overall, three-quarters of respondents said their operations were “somewhat better” (47.6%) or “significantly better” (28.4%) than pre-pandemic levels.

Inflation

Across the board, AANHPI business owners in the state identified inflation as the single most important problem facing their business today, mirroring the sentiment of small businesses nationwide.

New Customers

Business referrals and networking within the AANHPI community were mentioned in many of the executive interviews. Participants mentioned the importance of starting their business focused solely on building a customer base upon business origination within their AANHPI community and expanding it through marketing and word-of-mouth.

Safety

When asked how concerned they were about safety on their business premises, more than 80% of survey participants had some level of concern. Those who said they were “very concerned” or “extremely concerned,” ranged from 20%-29%, varying by region.

Source of Inspiration

Many of the participants in our executive interview sessions referenced their family as a significant source of inspiration and support in ongoing business operations. Families played roles in different ways for participants, including financial support, emotional support, passed down business operations, and mentorship.

| Impact | Employment | Labor Income | Value Added | Output |

|---|---|---|---|---|

| Direct | 1,230,120 | $ 65,051,291,000 | $ 97,956,982,473 | $ 175,059,219,645 |

| Indirect | 373,353 | $ 33,766,424,982 | $ 51,376,029,878 | $ 95,035,441,964 |

| Induced | 394,396 | $ 29,117,426,518 | $ 51,461,206,293 | $ 82,689,912,479 |

| TOTAL | 1,997,869 | $ 127,935,142,500 | $ 200,794,218,644 | $ 352,784,574,088 |

| Employment | Labor Income | Value Added | Output | |

|---|---|---|---|---|

| LA/OC | 1,006,964 | $ 59,658,681,696 | $ 95,671,067,829 | $ 168,414,954,084 |

| SF Bay Area | 348,830 | $ 27,984,037,082 | $ 41,595,630,940 | $ 64,045,341,274 |

| San Diego | 116,473 | $ 5,461,634,760 | $ 8,398,303,918 | $ 15,726,136,210 |

| Inland Empire | 114,980 | $ 4,909,833,602 | $ 6,892,831,293 | $ 13,275,324,817 |

| All Other CA | 100,003 | $ 3,666,419,584 | $ 5,149,429,316 | $ 9,942,766,879 |

| Statewide | 1,687,251 | $ 101,680,606,726 | $ 157,707,263,299 | $ 271,404,523,265 |

| Answer Choices | Inland Empire | LA/OC | San Diego | SF Bay |

|---|---|---|---|---|

| High cost of living | 46% | 48% | 51% | 48% |

| High salary expectations | 41% | 40% | 22% | 39% |

| Lack of qualified candidates | 29% | 24% | 26% | 25% |

| High competition for talent | 29% | 24% | 29% | 17% |

| Insufficient applicant pool | 15% | 19% | 15% | 15% |

| Inadequate local training programs | 17% | 15% | 15% | 17% |

| Don’t Know/Does not apply to my business | 14% | 13% | 10% | 11% |

| Other | 1% | 2% | 1% | 1% |

| Answer Choices | Inland Empire | LA/OC | San Diego | SF Bay | NFIB |

|---|---|---|---|---|---|

| Inflation | 22% | 29% | 27% | 27% | 24% |

| Taxes | 17% | 14% | 16% | 9% | 13% |

| Poor sales | 8% | 13% | 11% | 17% | 8% |

| Cost of labor | 17% | 13% | 11% | 16% | 9% |

| Finances & interest rates | 11% | 11% | 12% | 7% | 4% |

| Competition from large businesses | 6% | 6% | 12% | 8% | 5% |

| Cost/availability of insurance | 4% | 4% | 1% | 4% | 6% |

| Quality of labor | 7% | 4% | 3% | 5% | 21% |

| Other (please specify) | 0% | 3% | 1% | 2% | 1% |

| Government regulation | 8% | 3% | 4% | 7% | 8% |

| Answer Choices | Inland Empire | LA/OC | San Diego | SF Bay |

|---|---|---|---|---|

| Not at all concerned | 17% | 19% | 16% | 16% |

| Slightly concerned | 25% | 30% | 25% | 26% |

| Moderately concerned | 27% | 23% | 36% | 29% |

| Very concerned | 16% | 15% | 10% | 16% |

| Extremely concerned | 13% | 10% | 10% | 9% |

| Not applicable to my business | 3% | 4% | 4% | 4% |

FROM OUR RESEARCH FINDINGS

From our research findings, we make the following key policy recommendations to community and business leaders, as well as decision makers in local and state government.

While not exhaustive, these recommendations are among those policy tools and interventions that we believe should be prioritized for future study, consideration and implementation, to advance economic inclusivity in the state.

Enhancing Marketing Partnerships and Placement

We heard and saw from AANHPI firms the ardent desire for more marketing programs and support, to increase their sales and commercial visibility. Marketing, however, should not be relegated to only once-a-year cultural holidays and special events. We encourage local leaders to expand their thinking on marketing AANHPI businesses and take a more integrated approach with existing local and regional marketing and branding efforts. Tourism authorities should also take note, and engage AANHPI business owners on their marketing goals and activities, and incorporate them into programming and placement opportunities.

Creating a Business Resiliency Fund

While we share and acknowledge the supporting data indicating broad resiliency within California AANHPI businesses, we are mindful that there are shuttered businesses that permanently closed during the pandemic that are not a part of our datasets, and others that are struggling financially and/or operationally today. We encourage cities, counties, and the state of California to consider establishing Business Resiliency Funds, to help educate, train and equip economically vulnerable business owners with anti-fragile tools and techniques to prepare for the next disaster or economic event. This should be done in partnership with business organizations and integrated into existing civic efforts to plan for natural disasters.

Creating Access to Capital and Multilingual Financial Literacy Programs

Breaking down structural barriers, cultural factors and discrimination in access to capital takes time, and sustained efforts are what is required to made progress in facilitating greater financial literacy and opportunity to a diverse and dynamic business community. We advise local and state governments to evaluate the effectiveness of existing financial literacy programs for business owners, and the performance measures used to determine effectiveness in engaging multilingual business owners of color. Existing banks and other financial institutions should partner with municipalities, set goals and pool resources together to improve banking and lending relationships with diverse communities, and combat language barriers and discrimination in lending.

Public Improvements to Urban Commercial Corridors

With most AANHPI business owners in urbanized areas, mobility of goods and customers is vital to commercial success. We identified the high interest of public transportation improvements among our survey respondents, and would encourage more community engagement, partnerships and surveys by transit agencies to ensure that all business owner voices are reflected in public decision-making, not just the largest and most prominent business and chamber stakeholders. We would also include the consideration of AANHPI commercial corridors for road repair and improvements, and multi-modal transportation options for customers and residents.

Promoting Intergenerational Business Transfer Programs

With so many first-generation AANHPI business owners in the state, greater thought should be given to establishing mentorship and support programs for second- and third-generation proprietors taking over their family businesses. Programs should focus on success strategies for business modernization, financial literacy and technological adaptation, to ensure that businesses can continue to grow. With many small business owners struggling under economic uncertainty, inflation and marketplace changes, transferring and retaining business ownership and family traditions to the next generation should be a viable choice for more California entrepreneurs in the future.

Investing in Public Safety and Anti-Discrimination Solutions

There is merit in expanding public safety measures, including funding local and state anti-hate public awareness campaigns, more community policing programs to build relationships and trust between law enforcement and business members, and addressing the law enforcement officer recruitment and retention crisis in the state, particularly in urban cities. AANHPI proprietors also stand to gain from additional staffing and resources to sufficiently empower local and state civil rights divisions where business owners can report discrimination and hate incidents, and swift responses to incidents can be met. Strategies to systematically inform and educate new and existing business owners on anti-hate resources and hotlines should be considered by municipalities.

Expanding Data Collection and Research on Minority Owned Businesses

Current and relevant data, particularly on the local and state level, requires on-going investments that build upon existing research methods and models. Federal datasets are less reliable and useful for localized analysis and must be supplemented with additional data. We believe with the growth of minority-owned businesses in the state should follow additional resources for business ownership research and analysis, to monitor, at a minimum, for marketplace and regulatory barriers.

NEW INSIGHT

This policy brief provides new insight, dimension and perspective to the state of AANHPI-owned businesses in California.

There is considerable evidence that suggests that AANHPI proprietors have largely recovered from the pandemic and made significant strides in business development and growth since that time. Their economic contributions to the state are measurable, and significant. We also see hallmarks of business resilience and strength. Still, we have highlighted the challenges and barriers that AANHPI entrepreneurs face and identified the potential for targeted inventions that can foster greater economic inclusivity in the state.

Moving forward, we believe that further research is needed to evaluate the progress of AANHPI enterprises in post-pandemic California, and more business development resources should be concentrated on marketing, capital, and marketplace opportunities. Fostering greater community dialogue on racism, discrimination, and systemic barriers can also help our state heal from the past and build social cohesion and equity that are becoming less common in the world today. The future of AANHPI businesses in the state is bright, but it will require a sustained commitment to economic inclusivity from policymakers, business leaders and community members alike.

Methodology

Using a number of analytical tools and data sources, we evaluated the economic relationships, fiscal health and operational stability of Asian American, Native Hawaiian and Pacific Islander (AANHPI) owned businesses in post-pandemic California.

First, we retrieved the most current public data available on AANHPI-owned businesses – the United States Census Bureau’s Annual Business Survey, the Nonemployer Statistics by Demographics series (NES-D), and the American Community Survey 5-Year Estimates Public Use Microdata Sample (PUMS). We evaluated this data using Microsoft Excel, geographic information systems (GIS) mapping software, and IMPLAN, the best-in-class econometric modeling software. Our analysis informed the questions we incorporated into our statewide and regional surveys of AANHPI proprietors in California. Using a premier online survey instrument and audience panel service, we explored a number of major business and community-focused issues facing AANHPI business owners, and included benchmark surveys for comparison purposes. Following our surveys, we conducted twenty-one executive interviews of AANHPI business owners from across the state, to provide more narrative and personal context to the data points and questionnaire responses we tabulated as part of our investigation.

Due to a number of key challenges, Asian American, Native Hawaiian and Pacific Islander-owned businesses in the country had a more complex and longer recovery from the COVID-19 pandemic than non-AANHPI-owned businesses. The pandemic disrupted small enterprises nationwide, with California AANHPI enterprises among the hardest hit. Despite California’s economic recovery, more research is needed on the unique post-pandemic recovery trajectory of AANHPI firms. This knowledge gap makes it difficult to determine whether these firms receive equitable support and resources compared to non-AANHPI firms, and whether they are regaining their pre-pandemic financial and operational stability.

About the Asian Business Association Foundation

The Asian Business Association Foundation (ABAF) is a 501(c)(3) nonprofit organization dedicated to strengthening underserved Asian American,

Native Hawaiian, and Pacific Islander (AANHPI) communities through leadership and education. For more than 20 years, the ABAF has provided community and culturally specific programming for leadership education and development, economic equity and advancement through no-cost technical assistance for minority business enterprises, and scholastic scholarships for high school, college and university students.

Funding Provided By:

About AAPI Data

AAPI Data is a leading research and policy organization producing accurate data to shift narratives and drive action toward enduring solutions for Asian American, Native Hawaiian and Pacific Islander communities.

AAPI Data aspires to transform public and private systems to ensure that all AA and NHPI communities are recognized, valued and prioritized.

About CAAPIA

The California Commission on Asian and Pacific Islander American Affairs (CAPIAA) was established in 2002 and is charged with elevating the political, economic, and social issues of Asian and Pacific Islander Americans (APIA) in California.

The Commission advises the Governor and the Legislature on how to best respond to views, needs, and concerns of the state’s diverse and complex APIA communities. Additionally, the commission provides assistance to policymakers, state agencies, departments, and commissions to develop appropriate responses and programs that meet the needs of APIA communities, including focus on cultural language sensitivity, and hate incident and hate crime prevention measures.